What Is Cryptocurrency and Can It Replace Cash?

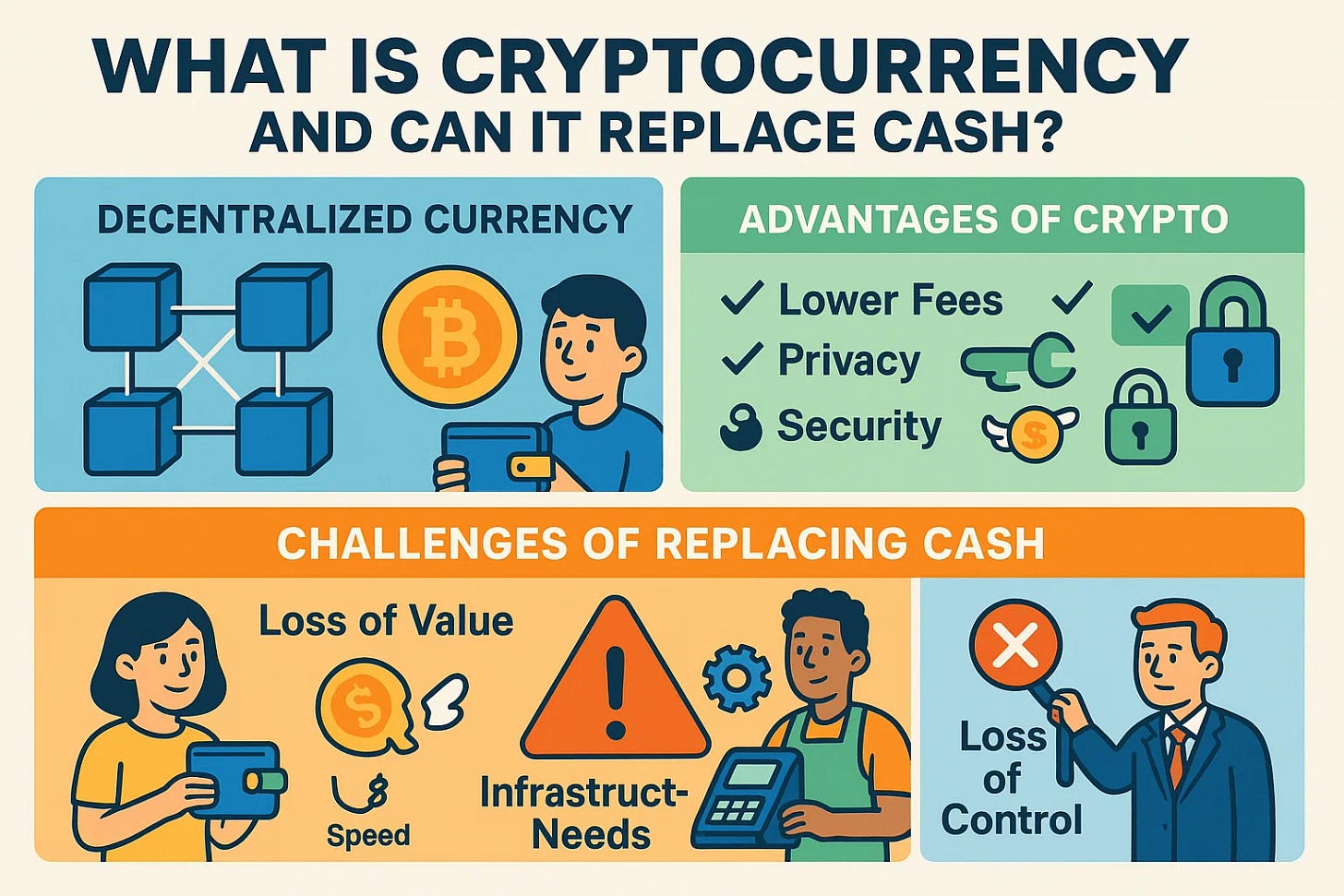

What is cryptocurrency, and could it replace cash in the future? Discover how digital currencies work and what they mean for the future of money.

In a world rapidly shifting toward digital transactions, a question looms large: Can cryptocurrency replace cash?

From Bitcoin’s mysterious beginnings to central banks issuing their own digital currencies, cryptocurrency has evolved from a fringe concept to a global financial force. But what exactly is cryptocurrency, how does it work, and is it truly capable of replacing physical money?

This post will walk you through the basics of cryptocurrency, its advantages and challenges, and the potential for a cashless future. Whether you're crypto-curious or deeply invested, this guide offers essential insights into one of the biggest financial debates of our time.

What Is Cryptocurrency?

Cryptocurrency is a form of digital or virtual currency that uses cryptography for security and operates independently of traditional banks or governments. Unlike fiat currencies like the U.S. dollar or euro, cryptocurrencies are decentralized and typically powered by blockchain technology.

Key features:

Decentralized: No central authority controls it.

Secure: Transactions are verified through cryptography.

Digital: Exists only in electronic form.

Immutable: Once confirmed, transactions cannot be altered.

Examples of Popular Cryptocurrencies:

Bitcoin (BTC) – The first and most well-known

Ethereum (ETH) – Smart contract functionality

Ripple (XRP), Litecoin (LTC), Solana (SOL) – Various speed, cost, and use case benefits

How Does Cryptocurrency Work?

At its core, cryptocurrency operates through blockchain — a distributed digital ledger. Here’s how a transaction typically works:

A user initiates a transaction.

The transaction is grouped with others into a "block."

The block is verified by network nodes (miners or validators).

Once verified, it’s added to the blockchain.

The transaction becomes permanent and traceable.

Decentralized verification means no single party can tamper with the data, providing trust without intermediaries.

Can Cryptocurrency Replace Cash?

This is the million-dollar question. While crypto has many advantages, full replacement of traditional cash involves overcoming major hurdles.

Benefits Over Cash

Global Reach: Cross-border transactions without fees or delays

Transparency: Public ledger for auditability

Security: Tamper-proof records

Financial Inclusion: Access for the unbanked and underbanked

Real-World Use Cases

El Salvador adopted Bitcoin as legal tender.

CBDCs (Central Bank Digital Currencies) like the digital yuan are being piloted worldwide.

Merchants like Overstock and Tesla (briefly) have accepted crypto.

Challenges to Replacing Cash

Despite potential, several barriers remain:

Volatility: Prices fluctuate wildly, making crypto unreliable for everyday use.

Scalability: Limited transactions per second vs. traditional systems like Visa.

Regulatory Hurdles: Governments are cautious due to risks of money laundering and tax evasion.

Adoption: Many consumers and businesses remain unfamiliar or skeptical.

What About Government-Issued Digital Currencies?

Governments are exploring CBDCs, which merge digital convenience with sovereign backing. Unlike decentralized cryptocurrencies, CBDCs are centralized but still digital.

Benefits:

Stability (tied to fiat)

Broader adoption due to legal framework

Central bank control

Concerns:

Privacy issues

Surveillance potential

Disruption of traditional banking

Cryptocurrency vs Cash: A Side-by-Side Comparison

Feature Cryptocurrency Cash Form Digital Physical Authority Decentralized Central banks Anonymity Pseudonymous Fully anonymous Speed Instant (varies by coin) Depends on location Security Blockchain encryption Risk of theft or loss Acceptance Growing, still limited Universal (for now)

Future Outlook: A Hybrid Financial Ecosystem

Instead of a full replacement, we’re more likely to see a hybrid future:

Cash for physical transactions and emergencies

Crypto for investment, tech-savvy payments, or specific use cases

CBDCs bridging digital innovation and government trust

This approach allows flexibility while maintaining economic stability.

Conclusion

Cryptocurrency is reshaping how we think about money, offering innovation in speed, transparency, and financial inclusivity. Yet, it’s unlikely to fully replace cash in the near future due to volatility, adoption challenges, and regulatory complexity.

The future lies in coexistence, not conquest.

Want to learn more and dive deeper into how cryptocurrency works?

Take the next step and explore our What Is Cryptocurrency guide here for expert insights and practical tips.