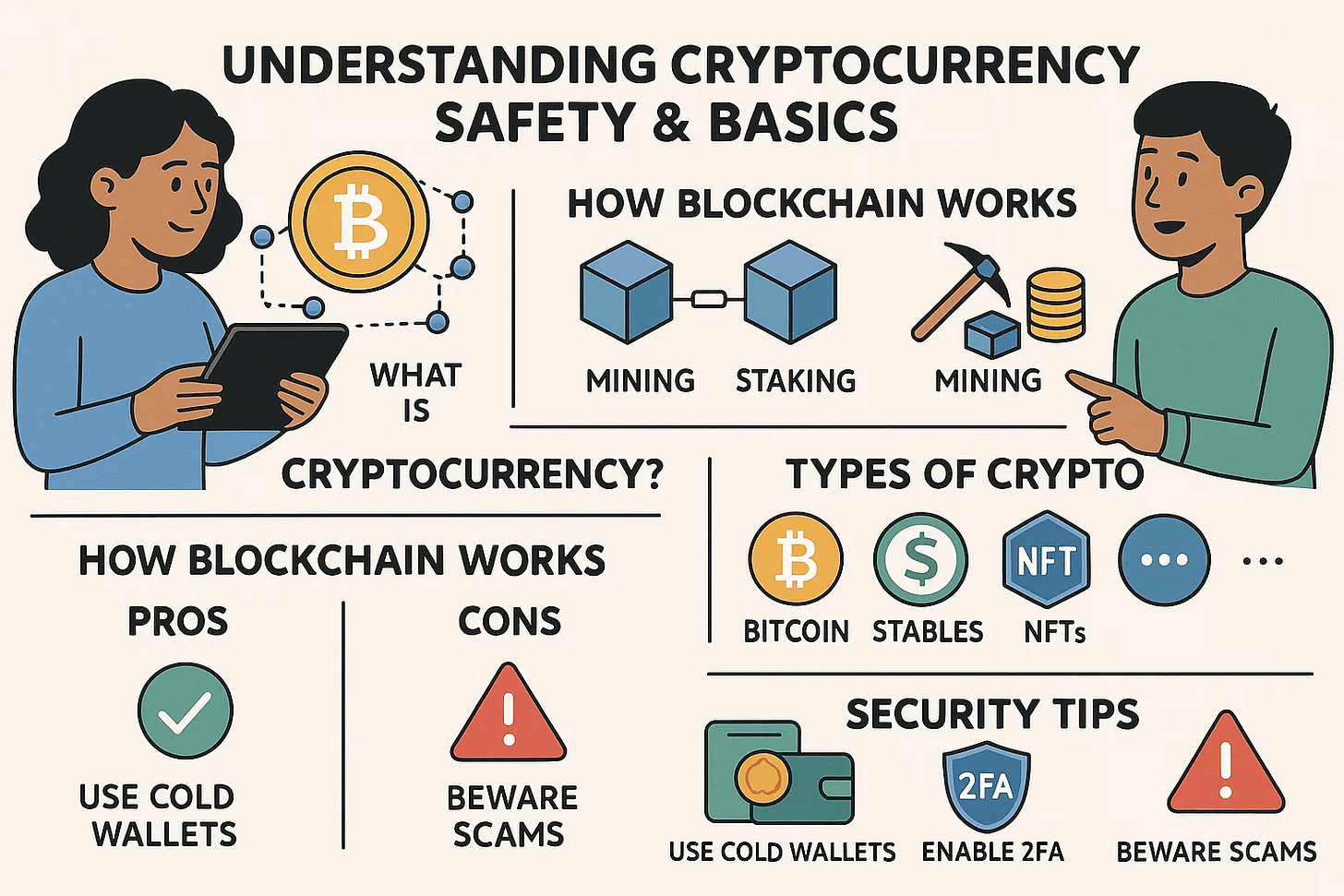

What is Cryptocurrency? A Guide to Understanding & Safe Use

Curious about what cryptocurrency is and if it's safe? Our guide explains crypto basics, key risks, and essential tips for secure investing and usage.

Cryptocurrency. You've heard the term, seen the headlines about Bitcoin's soaring highs and dramatic dips, and perhaps wondered if this digital gold rush is something you should explore or avoid. For many, the world of crypto feels like a complex, even intimidating, frontier. What exactly is cryptocurrency? How does it work? And, most importantly, is it safe to use or invest in?

This comprehensive guide will demystify cryptocurrency for you. We'll break down the fundamental concepts, explore the different types of digital currencies, and critically examine the safety aspects. By the end, you'll have a clearer understanding of what cryptocurrency is, its potential, its inherent risks, and how you can approach it with greater confidence and security.

What Exactly is Cryptocurrency?

At its core, cryptocurrency is a digital or virtual form of money that uses cryptography for security. Unlike traditional currencies issued by governments (like the US Dollar or the Euro), most cryptocurrencies are decentralized. This means they are not controlled by any single entity, like a central bank.

Key Characteristics:

Decentralized: Most cryptocurrencies operate on a technology called blockchain, which is a distributed ledger maintained by a network of computers. This decentralization makes them resistant to censorship and single points of failure.

Cryptography: Secure cryptographic techniques are used to verify transactions and control the creation of new units. This makes transactions secure and helps prevent fraud.

Digital Nature: Cryptocurrencies exist only in digital form. You store them in digital "wallets."

Peer-to-Peer Transactions: Transactions can often occur directly between users without the need for intermediaries like banks.

How Does Blockchain Technology Power Crypto?

Imagine a shared, digital record book that's duplicated and spread across thousands of computers. Every time a transaction happens, it's recorded as a "block" of data. This block is then cryptographically linked to the previous block, forming a "chain." This is the essence of blockchain.

Because the ledger is distributed and new blocks require consensus from the network to be added, it's extremely difficult for any single party to tamper with the transaction history. This transparency and immutability are core to the trust in many cryptocurrencies.

Types of Cryptocurrencies

While Bitcoin is the most well-known, there are thousands of different cryptocurrencies, often categorized as:

Bitcoin (BTC): The original cryptocurrency, often seen as a store of value, like "digital gold."

Altcoins: Any cryptocurrency other than Bitcoin. This includes:

Ethereum (ETH): The second-largest crypto, known for its smart contract capabilities, which allow for decentralized applications (dApps).

Other Large-Cap Coins: Projects like Cardano (ADA), Solana (SOL), and Ripple (XRP) each have unique features and use cases.

Stablecoins: These are designed to maintain a stable value by being pegged to a fiat currency (e.g., USDT, USDC pegged to USD) or other assets. They aim to offer the benefits of crypto (fast transactions, low fees) without the price volatility.

Meme Coins: Cryptocurrencies that originate from internet memes or have a humorous characteristic (e.g., Dogecoin, Shiba Inu). These are often highly speculative.

How Cryptocurrency Differs from Traditional Money

The primary difference lies in control and issuance. Traditional (fiat) money is controlled by central banks and governments, which can influence its supply and value. Cryptocurrencies are typically decentralized, with their supply often predetermined by their underlying code. Transactions can also be faster and cheaper, especially for international transfers, and offer greater privacy in some cases (though most blockchains are transparent).

Is Cryptocurrency Safe to Use and Invest In? The Big Picture

This is the million-dollar question, or perhaps the multi-trillion dollar question given the market's size. The answer is nuanced: cryptocurrency has the potential for significant rewards, but it also comes with substantial risks. Its safety depends on a variety of factors, including the specific cryptocurrency, the platforms you use, your understanding of the technology, and the security practices you adopt.

The allure is undeniable: stories of early Bitcoin adopters becoming millionaires and the promise of a new, democratized financial system. However, this exciting new landscape is also fraught with dangers, from extreme price volatility to sophisticated scams.

Factors Influencing Crypto Safety:

Technological Security: The underlying blockchain technology for major cryptocurrencies like Bitcoin is generally very secure.

Market Volatility: Prices can swing wildly in short periods.

Regulatory Environment: Governments worldwide are still figuring out how to regulate crypto, leading to uncertainty.

Individual Practices: How you store your crypto, the exchanges you use, and your awareness of scams significantly impact your personal safety.

Key Risks Associated with Cryptocurrency

Before diving into the crypto world, it's crucial to understand the potential pitfalls. The OCR'd article highlights several, and they remain pertinent:

1. Extreme Market Volatility

Cryptocurrency markets are notorious for their price volatility. Bitcoin, for example, saw a drop from $69,000 in 2021 to below $16,000 in 2022, before rallying again. Smaller cryptocurrencies can experience even more dramatic swings. This means you could see substantial gains, but you could also lose a significant portion of your investment quickly.

2. Security Risks: Scams and Hacks

The digital and often anonymous nature of crypto attracts scammers. The US Federal Trade Commission (FTC) has reported billions lost to crypto scams. Common threats include:

Phishing Scams: Fake websites or emails designed to steal your login credentials or private keys.

Malicious Tokens: Some "meme coins" or new tokens can have malicious code that prevents selling or drains wallets.

Exchange Hacks: While reputable exchanges invest heavily in security, they can still be targets. If an exchange is hacked and doesn't have sufficient reserves or insurance, users can lose funds.

SIM-Swap and Port-Out Scams: Scammers gain control of your phone number to bypass two-factor authentication.

3. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving globally. In the US, agencies like the Securities and Exchange Commission (SEC) have taken action against certain crypto projects and exchanges, creating uncertainty about whether some cryptocurrencies might be classified as securities. This can impact their price and availability on exchanges. However, the approval of Bitcoin ETFs and the anticipation of Ethereum ETFs signal a maturing view from regulators on established cryptocurrencies.

4. Lack of Investor Protection

Unlike traditional bank deposits (often insured by FDIC in the US) or brokerage accounts (SIPC protection), most cryptocurrency investments do not come with similar government-backed insurance. If an exchange goes bankrupt (like FTX infamously did) or you lose your crypto to a scam, there's often no recourse to recover your funds.

5. Complexity and Learning Curve

Understanding how cryptocurrency works, how to use digital wallets, manage private keys, and identify legitimate projects requires a significant learning curve. This complexity can be a barrier for newcomers and can lead to costly mistakes if not approached carefully.

6. Project Viability & High Failure Rate

According to data from sites like CoinGecko, a vast number of cryptocurrency projects have failed. While established players like Bitcoin and Ethereum are more resilient, investing in newer, less-established altcoins is highly speculative. Many will not survive long-term.

7. Losing Access to Your Wallet

If you manage your own crypto in a self-custody wallet, you are responsible for your private keys (or seed phrase). If you lose your seed phrase, you lose access to your cryptocurrency – permanently. Chainalysis has suggested that as much as 20% of all Bitcoin may be irretrievably lost, often due to lost keys.

How to Approach Cryptocurrency More Safely

While the risks are real, there are steps you can take to significantly enhance your safety and security when dealing with cryptocurrency. These echo the advice found in well-regarded crypto resources:

1. Educate Yourself Thoroughly

Before investing a single penny, invest time in learning.

Understand the specific cryptocurrency you're considering: What problem does it solve? Who is the team behind it? What is its tokenomics (supply, distribution)?

Learn about different types of scams and how to spot them.

Familiarize yourself with basic security practices.

2. Secure Your Assets: Wallets Explained

How you store your cryptocurrency is paramount.

Software Wallets (Hot Wallets): These are applications on your computer or phone (e.g., MetaMask, Exodus, Trust Wallet). They are convenient for frequent transactions but are connected to the internet, making them more vulnerable to online threats.

Hardware Wallets (Cold Wallets): These are physical devices (e.g., Ledger, Trezor) that store your private keys offline. This is the most secure way to store significant amounts of cryptocurrency as it keeps your keys isolated from internet-connected devices. You connect the hardware wallet only when you need to make a transaction, which you then approve on the device itself.

Seed Phrase Safety is CRITICAL:

Never share your seed phrase (or private keys) with anyone.

Store your seed phrase offline and securely. Write it down on paper (or engrave it on metal for durability) and keep it in a safe place, or multiple safe places.

Do not store your seed phrase digitally (e.g., in a text file on your computer, in an email, or in the cloud) where it could be hacked.

Consider making multiple copies and storing them in different secure locations.

3. Choose Reputable Exchanges

If you're buying, selling, or trading crypto, you'll likely use an exchange.

Research the exchange: Look for exchanges with a strong reputation, robust security measures, transparency (e.g., proof of reserves), and good customer support. Examples often cited for their better practices include Coinbase (publicly traded, subject to SEC reporting) and Kraken (known for transparency).

Enable all security features: Use strong, unique passwords and enable two-factor authentication (2FA).

Consider withdrawing to self-custody: For long-term holding, many experienced users prefer to move their crypto off the exchange and into their own hardware wallet to avoid risks like exchange insolvency or hacks.

4. Practice Strong Security Hygiene

These are good habits for all your online activities, but especially crucial for crypto:

Use strong, unique passwords for every crypto-related account. A password manager can help.

Enable Two-Factor Authentication (2FA): Use an authenticator app (like Google Authenticator or Authy) rather than SMS-based 2FA, which is vulnerable to SIM-swap attacks.

Beware of unsolicited offers and links: Don't click on suspicious links or respond to DMs promising free crypto or guaranteed returns.

Keep your software updated: Ensure your operating system, browser, and antivirus software are up to date.

5. Start Small and Diversify (If You Invest)

Only invest what you can afford to lose. The crypto market is speculative.

Consider starting with a small amount to get familiar with the process.

Diversification can be tricky in crypto as many assets are highly correlated, but don't put all your eggs in one, especially a very new or speculative, basket.

6. Beware of "Too Good to Be True" Offers

If something sounds too good to be true (e.g., guaranteed high returns, "can't-miss" presales hyped by unknown influencers), it almost certainly is a scam. Avoid FOMO (Fear Of Missing Out) driven decisions.

Are Specific Types of Crypto Safer?

Not all cryptocurrencies carry the same level of risk.

Is Bitcoin Safe?

Bitcoin is generally considered one of the safer cryptocurrencies, though "safe" is relative in this volatile market.

Longest track record and largest market capitalization.

Most decentralized and secure network.

Increasing institutional adoption and products like Bitcoin ETFs make it more accessible and potentially reduce some volatility over time.

Its fair launch (no pre-mine or presale) and clear status as a digital commodity simplify some regulatory concerns.

However, it's still highly volatile compared to traditional assets.

Are Stablecoins Safe?

Stablecoins aim to provide stability by pegging their value to assets like the US dollar.

Fiat-backed stablecoins like USDC and USDT are generally considered safer among stablecoins, provided they are fully backed by reserves and audited regularly. They can be useful for holding value between trades or earning passive income.

Risks still exist:

De-pegging: Events can cause them to temporarily (or permanently in some cases) lose their $1 peg. USDC briefly depegged in 2023 during the Silicon Valley Bank crisis when a portion of its reserves was held there. Tether's USDT has also faced scrutiny over its reserves in the past.

Algorithmic stablecoins: These have proven much riskier. The collapse of UST (TerraUSD) in 2022 wiped out billions and sent shockwaves through the market. These rely on complex algorithms and often paired assets, which can fail catastrophically.

The Future of Cryptocurrency and Its Safety

The cryptocurrency landscape is constantly evolving. We're seeing:

Growing Adoption: More individuals and institutions are exploring cryptocurrencies.

Institutional Interest: The launch of Bitcoin ETFs is a major step, and more regulated crypto investment products are likely.

Potential for Clearer Regulations: As the industry matures, governments will likely establish clearer regulatory frameworks, which could improve investor protection and reduce uncertainty, though it may also introduce new compliance burdens.

Ongoing Innovation: New blockchain technologies, applications, and security solutions are continuously being developed.

While the future is bright with potential, the journey will likely continue to have its share of volatility and challenges. Safety will always depend on a combination of technological advancements, regulatory clarity, and, crucially, individual diligence.

Conclusion

So, what is cryptocurrency? It's a revolutionary digital asset class built on groundbreaking technology, offering a new paradigm for finance and beyond. Is it safe? The answer is complex. While the core technology of established cryptocurrencies like Bitcoin is robust, the broader ecosystem carries significant risks, including extreme volatility, scams, regulatory uncertainties, and the personal responsibility of securing your assets.

Investing in or using cryptocurrency is not for the faint of heart. It demands thorough research, a cautious approach, and a commitment to robust security practices. By educating yourself, understanding the risks involved, utilizing secure storage like hardware wallets, choosing reputable platforms, and never investing more than you can afford to lose, you can navigate the world of cryptocurrency more safely. The power and responsibility, to a large extent, rest with you.

Ready to learn more about the fundamentals of cryptocurrency and how it's changing the world? Explore our in-depth resources on What is Cryptocurrency at CryptoCrafted.org to continue your educational journey.