How Is a Bubble in Cryptocurrency Different From Stock Market Bubbles?

Discover how cryptocurrency bubbles differ from traditional stock market bubbles, including unique volatility patterns, market maturity factors, and essential strategies to protect your investments.

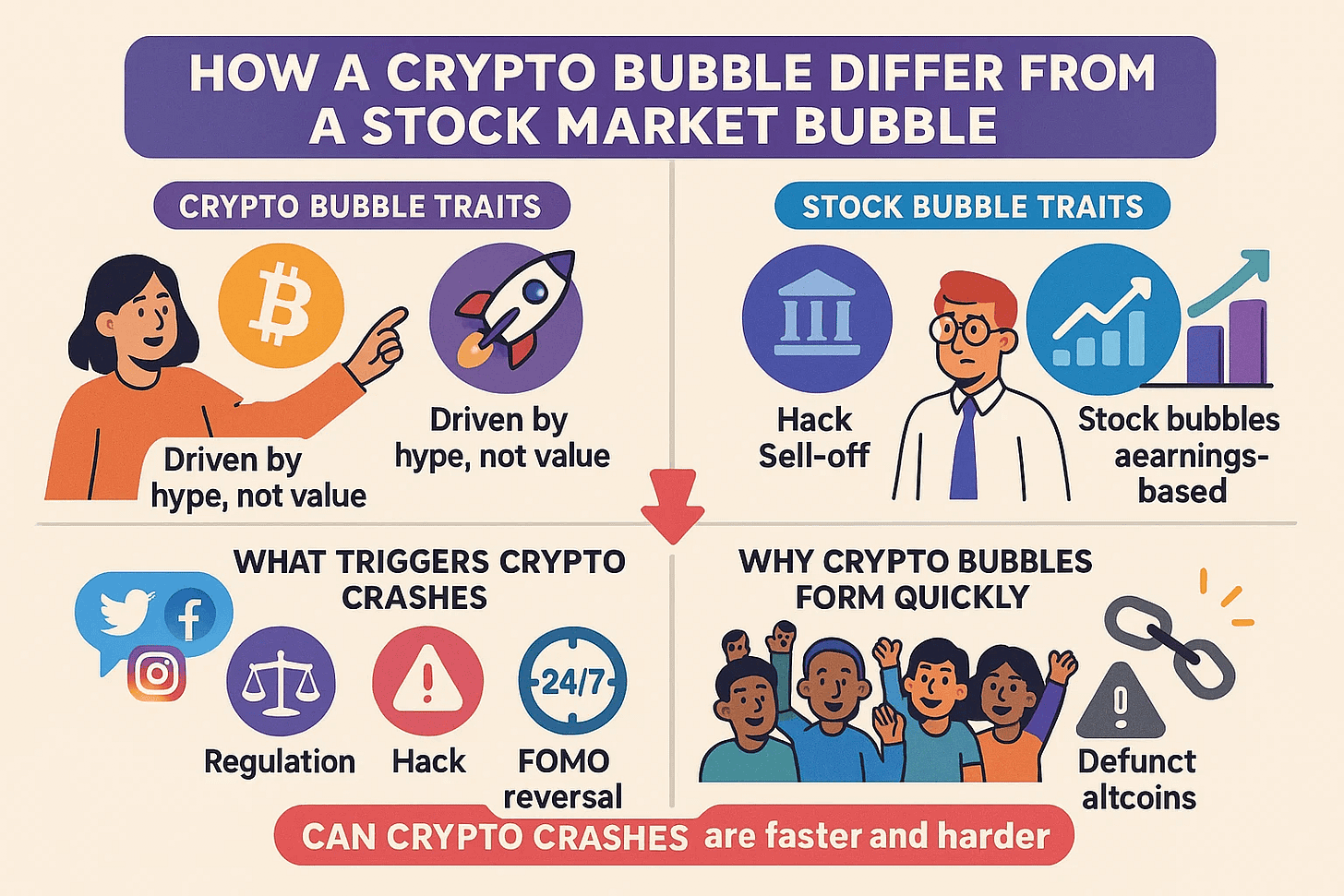

Have you ever wondered why cryptocurrency markets seem to experience more dramatic boom-and-bust cycles than traditional stock markets? While both markets can form bubbles, the differences in how these bubbles develop, expand, and ultimately burst can be substantial—and understanding these differences is crucial for any modern investor.

In today's financial landscape, where digital assets increasingly compete with traditional investments for attention, knowing how to identify and navigate market bubbles in both spaces can mean the difference between capitalizing on opportunities and suffering devastating losses.

What Defines a Market Bubble?

Before diving into the differences, it's important to understand what constitutes a market bubble. A bubble occurs when asset prices rise dramatically over a short period, far exceeding the asset's intrinsic value. This surge is typically driven by speculative behavior rather than fundamental value.

The classic bubble cycle typically follows four distinct phases:

Stealth Phase: Early adopters begin investing while the general public remains unaware.

Awareness Phase: Media coverage increases, attracting more investors as prices rise more rapidly.

Mania Phase: Widespread FOMO (Fear Of Missing Out) drives prices to unsustainable heights.

Blow-off Phase: Reality sets in, panic selling occurs, and prices collapse rapidly.

While this cycle applies to both cryptocurrency and stock market bubbles, the way these phases manifest and their intensity can differ significantly.

Speed and Volatility: Crypto's Accelerated Timeline

The most obvious difference between cryptocurrency and stock market bubbles lies in their timeframes and volatility levels.

Cryptocurrency Bubble Characteristics:

Rapid Formation: Crypto bubbles can form and burst within weeks or months, rather than years

Extreme Price Swings: Price increases of 1,000% or more are not uncommon

24/7 Trading: Continuous trading means movements can occur at any time

Global Accessibility: Lower barriers to entry allow more participants worldwide

Take Bitcoin's 2017 surge as an example. The price skyrocketed from around $1,000 to nearly $20,000 within a single year, only to crash back down to about $3,000 by the end of 2018—a classic bubble cycle compressed into approximately 18 months.

Stock Market Bubble Characteristics:

Gradual Development: Stock bubbles typically form over years or even decades

Moderate Volatility: Even during bubbles, daily price swings are usually less extreme

Limited Trading Hours: Circuit breakers and trading hours create cooling-off periods

Institutional Participation: Higher barriers to entry and significant institutional involvement

The dot-com bubble, a famous stock market example, took several years to fully develop from the mid-1990s until its burst in 2000. The NASDAQ's rise, while substantial, was measured in hundreds of percentage points rather than thousands.

Market Maturity and Regulation

Another fundamental difference between cryptocurrency and stock market bubbles lies in the maturity and regulatory environment of each market.

Cryptocurrency Markets:

Nascent Stage: Most cryptocurrencies have existed for less than 15 years

Evolving Regulation: Regulatory frameworks are still developing in many jurisdictions

Limited Historical Data: Fewer historical precedents to guide investment decisions

Experimental Technology: Many projects are built on emerging, unproven technologies

Stock Markets:

Centuries of History: Stock markets have existed for hundreds of years

Comprehensive Regulation: Well-established legal frameworks and oversight

Extensive Historical Data: Rich datasets spanning multiple economic cycles

Established Business Models: Companies typically have proven revenue streams

This maturity gap explains why cryptocurrency markets experience more frequent bubbles. Without established valuation methods and regulatory guardrails, speculation can more easily drive prices to irrational levels.

Investor Demographics and Behavior

The types of investors participating in each market and their behavioral patterns also contribute to differences in bubble dynamics.

Cryptocurrency Investor Profile:

Younger Demographics: A higher percentage of millennials and Gen Z investors

Tech-Oriented: Greater comfort with technological innovation and digital assets

Risk-Tolerant: Often willing to accept higher volatility for potential higher returns

Social Media Influence: Highly susceptible to influencer opinions and online communities

Stock Market Investor Profile:

Diverse Age Groups: Broader representation across generational cohorts

Institutional Dominance: Greater influence from professional fund managers and institutions

Fundamentals-Focused: More emphasis on traditional metrics like P/E ratios and earnings

Professional Analysis: Greater reliance on analyst reports and established financial media

These demographic differences impact how information spreads and how quickly sentiment can shift. Cryptocurrency markets, with their younger, more connected investor base, can see sentiment change rapidly through social media, accelerating both bubble formation and bursting.

Valuation Metrics and Fundamentals

Perhaps the most significant difference between cryptocurrency and stock market bubbles lies in how assets in each space are valued.

Cryptocurrency Valuation Challenges:

Utility vs. Investment: Many tokens serve both as utilities and investments

Network Effects: Value often depends on adoption metrics rather than revenue

Speculative Future Use: Current prices frequently reflect potential future applications

Novel Metrics: Indicators like Total Value Locked (TVL) or transaction volume rather than earnings

Stock Market Valuation Methods:

Established Metrics: Price-to-earnings ratios, dividend yields, and cash flow analysis

Quarterly Reports: Regular disclosure of financial performance

Industry Benchmarks: Comparison with similar companies in the same sector

Analyst Coverage: Professional evaluation of company prospects and fair value

Without established valuation frameworks, cryptocurrency markets can more easily diverge from fundamental value, creating more frequent and extreme bubble conditions.

Case Study: Comparing Bitcoin's 2017 Bubble to the Dot-Com Bubble

To illustrate these differences, let's compare two famous bubbles: Bitcoin's 2017 surge and the dot-com bubble of the late 1990s.

Bitcoin's 2017 Bubble:

Timeline: Approximately 12-18 months from start to crash

Price Increase: Nearly 2,000% at its peak

Market Dynamics: Driven largely by retail investors and ICO speculation

Aftermath: Many projects disappeared, but the core technology continued advancing

The Dot-Com Bubble:

Timeline: Developed over 5+ years before bursting

Price Increase: The NASDAQ rose approximately 400% at its peak

Market Dynamics: Involved both retail and significant institutional investment

Aftermath: Many companies failed, but the internet itself transformed the economy

While both bubbles shared similarities in their excessive optimism about new technology, the cryptocurrency bubble formed and burst much more quickly and with greater price extremes.

How to Prepare for Both Types of Bubbles

Whether investing in cryptocurrencies or stocks, preparing for potential bubbles is essential. Here are strategies that work for both markets, with important adaptations for each:

For Cryptocurrency Investors:

Conduct Thorough Research: Focus on technology fundamentals, use cases, development team, and community strength.

Diversify Broadly: Spread investments across multiple cryptocurrencies, traditional assets, and different blockchains.

Set Aggressive Stop-Losses: Use tighter stop-loss orders to account for higher volatility.

Stay Technically Informed: Understanding the underlying technology provides an edge.

Be Wary of Social Media Hype: Question narratives that spread rapidly through online communities.

For Stock Market Investors:

Focus on Fundamentals: Pay close attention to earnings, revenue growth, and balance sheet strength.

Value-Based Approach: Consider valuation metrics relative to industry averages and historical norms.

Income Components: Consider investments that provide dividends or other income streams.

Economic Context: Analyze how broader economic conditions might impact specific sectors.

Professional Guidance: Consider financial advisors with experience navigating previous market cycles.

Recognizing When a Bubble Is About to Burst

Identifying the peak of a bubble is notoriously difficult, but certain warning signs can help investors in both markets:

Universal Warning Signs:

Excessive Media Coverage: When mainstream outlets can't stop talking about an asset class

Unrealistic Return Expectations: Predictions of indefinite extraordinary returns

New Investor Surge: When people with no prior investment experience rush into the market

Disconnect from Fundamentals: Prices that can't be justified by any reasonable analysis

Cryptocurrency-Specific Warning Signs:

Parabolic Price Charts: Near-vertical price increases over short periods

Project Proliferation: A sudden explosion of similar projects or tokens

Regulatory Attention: Increased scrutiny from government agencies

Technical Warning Signs: Declining transaction volumes despite rising prices

Stock Market-Specific Warning Signs:

Elevated P/E Ratios: Industry-wide price-to-earnings ratios far above historical averages

IPO Frenzies: Numerous companies going public with little revenue or profitability

Margin Debt Increases: Investors borrowing heavily to purchase more stocks

Narrowing Market Leadership: Fewer stocks responsible for overall market gains

Conclusion: Different Bubbles, Similar Principles

While cryptocurrency and stock market bubbles differ significantly in their formation, intensity, and timeframes, the fundamental principles of bubble psychology remain consistent across both markets. Excessive optimism, speculative fervor, and the eventual return to reality are universal features of financial bubbles throughout history.

For investors, the key takeaway should be adaptability. Strategies that work in traditional stock markets may need adjustment for cryptocurrency markets—and vice versa. By understanding the unique characteristics of each market, investors can better prepare for inevitable market cycles, potentially preserving capital during downturns and positioning themselves for long-term success.

Remember that in both markets, the adage holds true: markets can remain irrational longer than you can remain solvent. Patience, discipline, and continuous learning remain the best defenses against bubble-induced financial damage.

Ready to learn more about cryptocurrency fundamentals and how to navigate this evolving landscape? Discover what cryptocurrency really is and how it works to build a stronger foundation for your investment decisions.